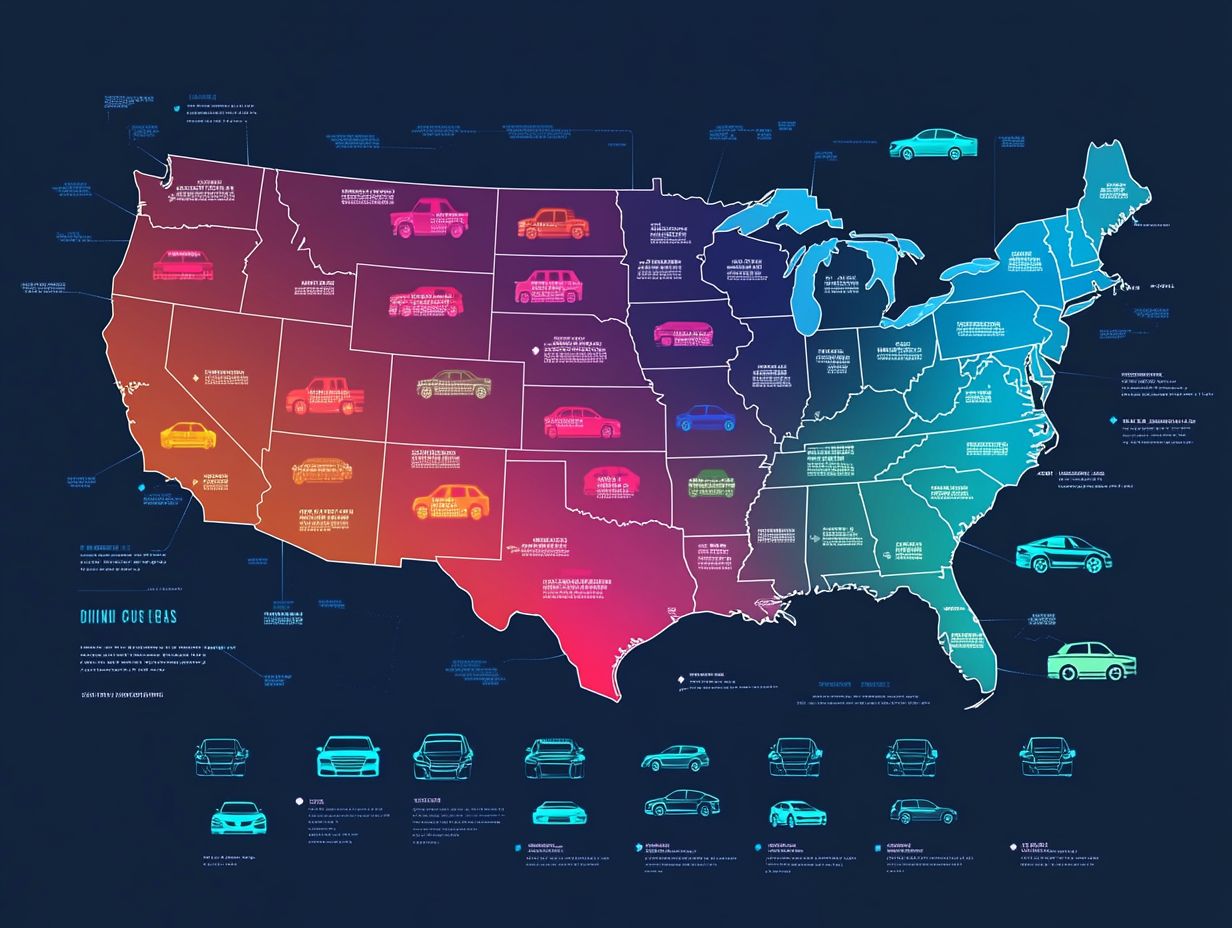

How Location Affects Car Prices Nationwide

When you start your car shopping, numerous factors come into play, yet one often overlooked aspect is your location.

Car prices can fluctuate dramatically based on where you find yourself, shaped by local economies, taxes, and even the regional climate. This article will explore how these geographic factors influence car pricing, examining specific models and their varying costs across different regions.

You ll also learn smart strategies to help you secure the best deals, regardless of your locale. Prepare for an enlightening exploration of the dynamic landscape of car pricing!

Contents

Key Takeaways:

- Location plays a crucial role in determining car prices, with factors like the local economy, taxes, and climate influencing the cost.

- Specific car models may have varying prices in different locations, making it important to research and compare prices before making a purchase.

- To get the best deals on cars, consider expanding your search radius and negotiating with dealerships in different locations.

Why Your Location Really Affects Car Prices!

Understanding the significance of location in car prices is essential for you, whether you’re a potential buyer or a current owner.

Various location factors can greatly influence auto insurance rates, premiums (the amount you pay for coverage), and overall insurance costs. Different regions present unique characteristics think varying crime rates, population density, and traffic congestion that can affect not just the price of the vehicle itself but also the insurance policies and coverage limits (the maximum amount an insurer will pay).

State laws significantly shape the requirements for car insurance, underscoring the importance of acknowledging geographical differences when evaluating your car-related expenses.

Factors that Influence Car Prices in Different Locations

Multiple factors play a significant role in determining car prices across various locations, and grasping these elements gives you the power to make informed choices when shopping for vehicles and insurance.

Considerations such as regional demand, the local economy, and the specific insurance rates offered by different companies can greatly influence automotive pricing. Furthermore, obtaining precise insurance quotes tailored to these factors will shed light on how your location can affect overall vehicle costs and insurance premiums.

Local Economy and Demand

The local economy plays a crucial role in shaping the demand for vehicles, which directly influences both car prices and insurance premiums. In bustling metropolitan areas, when disposable income is on the rise, you ll likely see an increased demand for vehicles.

However, during economic downturns, sales may falter, leading to lower car prices. You ll want to understand how local economic conditions impact automotive trends if you re in pursuit of the best deals.

When your community is experiencing growth, residents like yourself are more inclined to invest in new vehicles, reflecting a sense of confidence in ongoing financial stability. This surge in demand can drive vehicle prices up, which in turn causes insurance premiums to rise as insurers adjust to the increased value of cars on the road.

On the flip side, during times of economic decline, you might notice potential buyers putting off their purchases. This can lead to a surplus of available vehicles, ultimately causing market prices to dip. Such a scenario directly influences insurance costs, prompting necessary adjustments to policy premiums based on the fluctuating value of insured vehicles.

Therefore, maintaining a sharp awareness of these dynamics is vital for anyone navigating the market. Don t miss out on the best deals!

Taxes and Fees

Taxes and fees associated with vehicle purchases can vary significantly by location, greatly impacting overall car prices and insurance rates. Different states have unique tax structures and additional fees that can substantially elevate the final cost of a vehicle. This ultimately influences how you perceive your insurance policies and their associated costs.

Knowing these differences can make a huge difference in your car buying experience! For example, in some areas, you might encounter a higher sales tax percentage or additional registration and title fees. These can collectively add hundreds, if not thousands, of dollars to your initial purchase price.

These costs don t simply vanish once you ve bought the car; they continue to affect ongoing expenses like insurance premiums. Insurers typically consider the total value of the vehicle including taxes and fees when calculating your rates.

Therefore, it’s wise for potential buyers to conduct thorough research and evaluate the financial implications of these expenses in their specific area. This knowledge gives you the power to budget effectively and helps you steer clear of unexpected financial burdens. Don t wait until it’s too late understand these costs now to avoid unexpected financial burdens later!

Regional Climate and Terrain

Regional climate and terrain play a crucial role in shaping car prices and insurance premiums, as they directly affect vehicle performance and the risk assessments made by insurance companies. If you live in an area prone to severe weather, like heavy snowfall or flooding, you might notice higher insurance costs. This is because the likelihood of accidents and claims tends to increase in such conditions.

Understanding how different climates influence your automotive choices and insurance policies is essential for making savvy decisions. For instance, if you re in a region where off-roading is the norm thanks to rocky or uneven landscapes, you might find yourself leaning toward rugged vehicles like SUVs or trucks. These often come with a heftier price tag upfront.

On the flip side, if you re in an urban area with a mild climate, compact cars might be the way to go. They generally attract lower insurance premiums since the risk of damage is reduced. Additionally, local regulations promoting eco-friendly vehicles can also sway your vehicle choice, impacting car pricing dynamics in particular climates.

By grasping the interplay between terrain, weather, and consumer preferences, you can empower yourself to make informed decisions when it comes to both purchasing and insuring your vehicle.

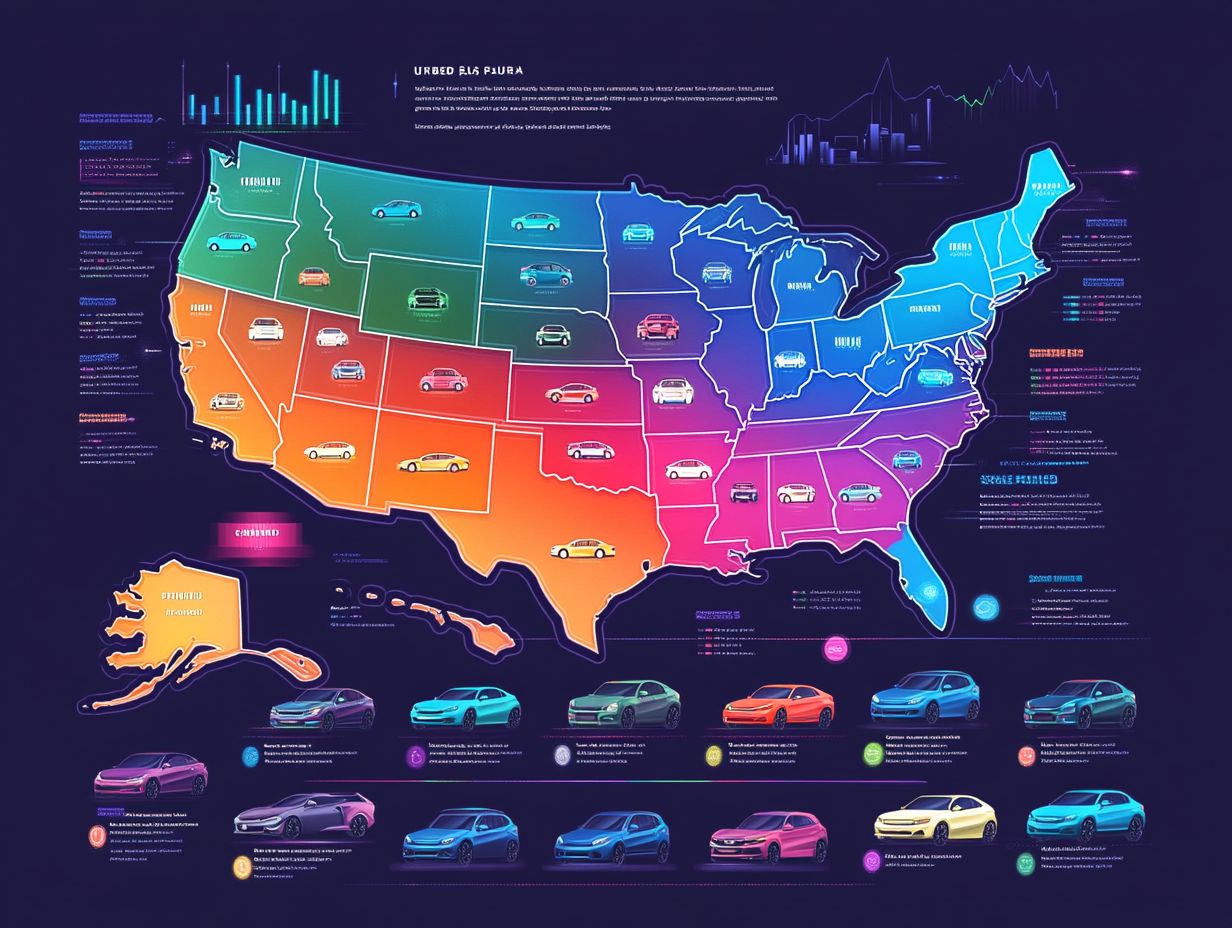

Impact of Location on Specific Car Models

The influence of location on specific car models can vary significantly, with different regions showcasing unique car preferences that also impact insurance costs. For example, in urban areas, you might notice a heightened demand for compact cars a sensible choice given the traffic congestion and parking challenges.

Conversely, rural regions often lean toward larger vehicles that can handle diverse terrains with ease. By understanding how these location factors shape car model trends, you can make informed decisions about the best vehicle options and insurance solutions tailored to your needs.

Case Studies of Popular Models

Examining case studies of popular car models reveals just how much location can shape demand, pricing, and insurance rates. For instance, if you’re in a region plagued by traffic congestion, you might find that smaller, fuel-efficient vehicles are in high demand. On the other hand, if you re located in an area known for its rugged terrains, SUVs and trucks are likely to reign supreme.

By analyzing these trends, you can gain valuable insights into the automotive industry s shifting landscape driven by geographical factors. In urban centers, where space is often a luxury, compact cars tend to enjoy higher sales and lower insurance premiums. This is largely due to their reduced replacement costs and the perception of enhanced safety.

Conversely, if you find yourself in suburban or rural areas, larger vehicles like pickup trucks or family-sized SUVs may command premium prices and insurance rates. This reflects their utility and meets the diverse needs of families or businesses in those locales.

Specific locations influence local regulations and aesthetic preferences, guiding consumer choices. By understanding these dynamics, you whether you’re a buyer or an insurer can make more informed decisions that align with market demands and regional trends.

Strategies for Finding the Best Deals in Different Locations

Finding the best deals on vehicles involves employing effective strategies that consider various location factors and the intricacies of the automotive industry. By grasping local market trends and seeking insurance quotes (estimates of how much insurance will cost you) from multiple providers, you can uncover opportunities to save money and make well-informed purchasing decisions.

Mastering these elements is crucial for maximizing value throughout the car-buying journey.

Researching and Comparing Prices

Researching and comparing prices is a crucial step in securing the best deal on a vehicle. It allows you to evaluate various options tailored to your specific location.

By gathering insurance quotes from multiple companies and analyzing vehicle pricing trends in your region, you can make informed decisions that align with your budget and needs. This process is essential in today’s competitive car market.

Understanding the local market dynamics is equally important. It helps you identify seasonal fluctuations and promotional periods that can affect pricing.

Utilize online platforms, dealership websites, and automotive forums to gain valuable insights into current market values and consumer experiences.

Engaging with local dealers is a smart move; they may offer unique incentives or packages that your online searches might miss. Ultimately, thorough research, combined with a strategic approach to gathering insurance quotes, will empower you in negotiations.

Doing so ensures you choose a vehicle that perfectly fits your lifestyle and financial situation.

Expanding Your Search Radius

Expanding your search radius can unlock a wealth of opportunities for securing better vehicle pricing and insurance costs. Different locations showcase distinct market dynamics.

By considering neighboring towns or even cross-state options, you may discover deals that simply aren’t available in your immediate area. This approach is particularly advantageous in the competitive automotive industry.

When you venture beyond your usual boundaries, you might find that certain regions have lower dealership overheads, leading to more competitive pricing overall.

Insurance rates can also vary based on geographic factors, making a broader search beneficial for uncovering more affordable premiums.

Some areas may even feature promotions or incentives exclusive to their local dealerships, further amplifying your potential for savings.

By embracing this wider exploration, you enhance your chances of securing a favorable price on your next vehicle and gain access to comprehensive insurance options tailored to your needs.

Negotiating with Dealerships

Negotiating with dealerships can dramatically influence vehicle pricing and lead you to better deals. This is particularly true when you come equipped with competitive insurance quotes and an understanding of market trends.

By grasping the intricacies of the automotive industry and the various factors that sway pricing, you empower yourself to advocate effectively during negotiations.

To negotiate like a pro, arm yourself with relevant data, such as recent vehicle sales in your area and average costs for the specific model you re eyeing.

Being aware of the dealership’s openness to making deals can also work in your favor; this might depend on their inventory levels or the arrival of new models.

Gathering multiple insurance quotes allows you to grasp the total cost of ownership more clearly. This thorough preparation not only boosts your confidence but also positions you as an informed negotiator, ready to navigate the often overwhelming car-buying process with finesse.

Frequently Asked Questions

How does location affect car prices nationwide?

Location has a big impact on car prices across the country. Understanding how regional pricing affects car choices reveals that different regions have varying tax rates, dealership competition, and demand for certain cars.

Are some regions more expensive for cars?

Yes, regions with higher living costs or high demand for specific brands often see higher car prices.

How do taxes and fees affect car prices?

Taxes and fees like sales tax and registration can greatly increase the overall price of a car. These costs vary based on where you buy your car.

Why is dealership competition important for car prices?

Dealership competition lowers car prices in some areas as they strive to attract more customers. This benefits buyers looking for the best deals.

Do some car brands have stable prices across the country?

Yes, popular car brands often maintain consistent prices nationwide due to their high demand.

Can I save money buying a car in another state?

Buying a car in a state with lower prices can be tempting. However, consider the transport costs and any tax or registration fees in your home state.