Understanding the Fine Print of New Car Deals

Navigating the world of new car deals can feel overwhelming, but it s an adventure waiting to happen!

This article distills everything you need to know, from the diverse financing and leasing options at your disposal to the crucial fine print that can often catch buyers off guard. It also offers valuable tips on how to negotiate effectively and sidestep common pitfalls, ensuring you secure the best possible deal.

Whether you re a first-time buyer or a seasoned pro, grasping these key elements can truly transform your car-buying experience.

Contents

- Key Takeaways:

- Types of New Car Deals

- Understanding the Fine Print

- How to Get the Best Deal

- Common Mistakes to Avoid

- Frequently Asked Questions

- What is the importance of understanding the fine print of new car deals?

- What are some common terms and conditions found in the fine print of new car deals?

- How can I ensure that I fully understand the fine print of a new car deal?

- Are there any hidden fees or charges in the fine print of new car deals?

- Can I negotiate the terms in the fine print of a new car deal?

- What should I do if I find something in the fine print that I don’t agree with?

Key Takeaways:

- Always read and understand the fine print of new car deals to avoid hidden fees and charges.

- Research and compare financing and leasing options to find the best deal for your budget and needs.

- Use negotiation tactics and avoid falling for sales tactics to get the best deal on a new car.

What are New Car Deals?

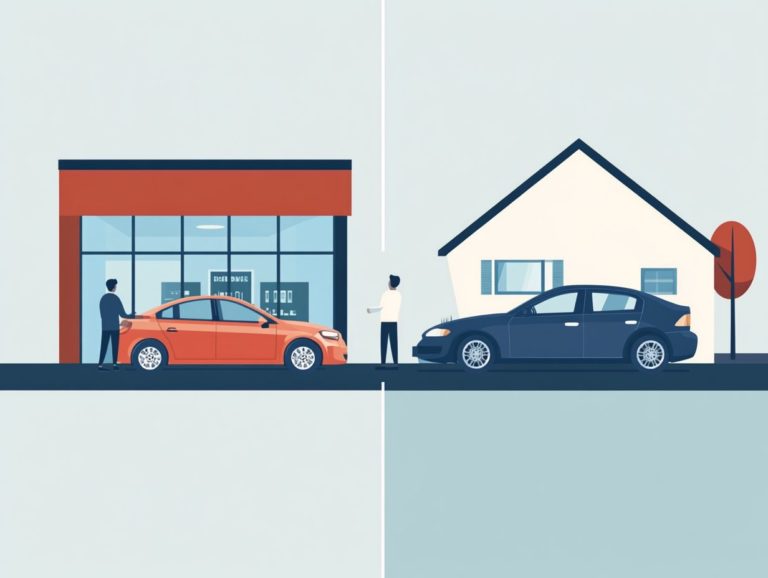

New car deals are offers that dealerships use to attract buyers in the busy car market. These deals often feature enticing discounts on purchase prices, financing options with appealing rates, or additional incentives that enhance the overall value of acquiring a new car.

To truly grasp these deals, you need to dive into various factors, such as the average dealership price, specific vehicle details, and any hidden fees that could impact your final purchase price.

By exploring the array of offers available, including manufacturer rebates and dealer-specific incentives extra benefits that specific dealerships offer to encourage purchases you can uncover substantial savings that fit your financial plan.

It’s essential to evaluate the overall value of these deals carefully. Compare financing rates from various dealers to find the best option.

Understanding the nuances of warranty coverage included in these deals is vital, as it can offer you peace of mind long after your purchase. Ultimately, as a well-informed buyer, understanding market dynamics will help you secure an exceptional deal on the vehicle you desire.

Types of New Car Deals

You ll discover a variety of new car deals tailored to meet your unique needs and financial situations as you consider purchasing a vehicle.

Depending on what you prefer, you can opt for financing options that lead to ownership over time, or you might find leasing arrangements appealing, offering lower monthly payments without the commitment of ownership.

It s important to note that dealer incentives can play a significant role in shaping the overall cost and pricing structure of these deals, potentially impacting your decision in a meaningful way.

Financing Options

When exploring financing options for a new car purchase, you ll discover a range of pathways that allow you to spread the cost over time and effectively manage your monthly payments.

These options typically include traditional loans from banks or credit unions, as well as dealer financing, where dealerships partner with financial institutions to provide tailored loans for their customers. Understanding the distinctions between these financing products and comparing dealership offers will enable you to make informed decisions.

If you consider bank loans, one notable advantage is the potential for lower interest rates, especially if you have good credit. This could lead to significant savings over the life of your loan. However, keep in mind that the application process might be more rigorous and can take longer than dealer financing, which often offers quick approvals but tends to come with higher rates.

Familiarize yourself with calculating monthly payments based on the loan amount, interest rate, and loan term. Before you sign any purchase agreement, it s essential to thoroughly review all terms and conditions. Understanding residuals, fees, and penalties will help you avoid any unwelcome surprises down the road.

Leasing Options

Leasing options offer you an enticing alternative if you’re seeking flexibility and lower monthly payments when acquiring a new car. By choosing to lease, you can enjoy the latest car features without the long-term commitment of ownership. This typically allows you to drive a new vehicle every few years.

It’s crucial to fully understand the terms of your lease agreement. Pay close attention to any mileage restrictions and potential extra charges to avoid unwelcome surprises.

Many dealerships also offer attractive incentives, such as reduced down payments or subsidized monthly rates, making leasing particularly appealing for those who relish driving a newer model without the full financial burden of a purchase. However, while leasing may cut down on your monthly costs, it’s wise to consider the cumulative expense over time. You might find that continually leasing cars could end up being more expensive in the long run.

On the other hand, owning a vehicle provides the freedom of unlimited mileage and the possibility of resale value. This makes it essential for you to carefully weigh your personal driving habits and financial situation before signing a lease agreement.

Understanding the Fine Print

Understanding the fine print in car purchase agreements is essential for securing a fair deal when you’re buying a new vehicle. Many buyers often miss hidden fees, terms, and conditions that can greatly influence the total cost of acquiring a car.

From documentation fees to hidden fees buried within sales contracts, being aware of these potential pitfalls enables you to sidestep unexpected costs and safeguard your rights as a buyer.

Hidden Fees and Charges

Did you know hidden fees could change your total cost? These charges can easily catch you off-guard when you re buying a new car, resulting in a total cost that’s likely higher than you anticipated. These fees might include add-on charges for services you didn t explicitly request or expect, along with standard documentation fees that dealerships often impose.

Beyond documentation fees, keep an eye out for destination charges, dealer preparation fees, and even extended warranty costs that can creep in without proper disclosure. These additional expenses can pile up quickly, significantly inflating the final purchase price.

To combat these hidden fees, it s wise to thoroughly review the sales contract, request a detailed breakdown of all charges, and don t hesitate to negotiate any fees that seem unreasonable. By being proactive and asking the right questions, you can save yourself a substantial amount of money during the purchasing process.

Terms and Conditions

The terms and conditions outlined in vehicle purchase agreements and sales contracts are essential for grasping the intricacies of the car buying process. You must familiarize yourself with these terms to ensure you are fully informed about critical aspects such as warranties, financing obligations, and potential penalties for early termination.

Understanding these agreements can significantly enhance your consumer protection and foster trust between you and the car dealership. These agreements often contain key components that influence not only your ownership rights but also your financial commitments and the scope of the warranties provided.

For example, specific clauses may detail what is covered under warranty service or outline the financial repercussions of missed loan payments. It s crucial to be aware of any fees associated with title transfers or maintenance requirements, as these can introduce unexpected costs to your overall ownership experience.

By diligently reviewing these components, you can make informed decisions that protect your investment and pave the way for a smoother car ownership journey.

How to Get the Best Deal

Securing the best deal on a new car demands strategic planning and thorough research. Understanding current car prices and market trends will maximize your purchasing power.

Use effective negotiation techniques to lower fees and gain dealer incentives, ultimately enhancing the overall value of your investment.

Negotiating Tactics

Negotiating tactics are essential for securing a favorable outcome when you re in the market for a new car. Mastering these skills allows you to snag the best possible deal, including lower prices and reduced fees.

Effective negotiation begins with a solid understanding of dealer incentives and a thorough knowledge of available financial products that can influence your monthly payments and overall affordability. Building trust with the dealership enhances your negotiation results and creates a more enjoyable purchasing experience.

To kick off the negotiation process, approach dealerships with a well-researched strategy, armed with insights about current promotions or rebates they might be offering. Strengthen your position by presenting alternative financing options, like loans from credit unions that feature lower interest rates. This shift can redirect the dealership s focus from just monthly payments to the overall cost of the vehicle.

Establishing clear communication and transparency during your discussions fosters rapport, making both you and the dealer feel more comfortable and respected throughout the process. This trust can encourage the dealer to be more flexible with pricing and terms, increasing your chances of a successful transaction.

Researching and Comparing Offers

Researching and comparing offers is an important step in your car-buying journey, enabling you to make informed decisions about your new vehicle. By tapping into resources like dealership comparisons, online platforms, and expert reviews, you can analyze car prices and uncover the best deals in the market. An educational guide to the various facets of the car-buying experience equips you to thoroughly evaluate your options.

Dive into your research to make the best car choice! Leverage a variety of online tools that aggregate dealership offers and provide user reviews. Websites specializing in automotive insights often feature advanced comparison tools, allowing you to not only compare prices but also incentives, financing options, and warranty plans.

Reading expert reviews adds credibility to your choices by shedding light on the pros and cons associated with different makes and models. Understanding the intricacies of car pricing, including negotiation potential and available financial products, is essential to ensure you receive the best value for your investment.

This comprehensive approach not only assists you in securing the best deal but also instills confidence as you make this significant purchase.

Common Mistakes to Avoid

When navigating the car-buying journey, it’s essential to be mindful of the common pitfalls that many buyers encounter, which can result in unexpected costs or unfavorable agreements.

From overlooking critical details in contracts to not fully grasping financing options, these missteps can significantly impact your overall purchasing experience. By staying well-informed about buyer guidelines and understanding your consumer rights, you can confidently steer clear of these traps and make a more informed decision that saves you money!

Overlooking Important Details

Overlooking important details during your car purchase can lead to significant issues down the road, affecting your satisfaction with the vehicle. You might neglect to carefully review sales contracts or miss critical information related to the vehicle identification number (VIN), which is the unique code that identifies your vehicle, warranty coverage, or financing terms.

Many buyers rush through paperwork, glossing over terms that could have long-term implications. Understanding how warranty coverage works can save you from unexpected repair costs later on. Checking the VIN is vital, as it reveals the car s history, including any accidents or title issues that may not be immediately apparent.

If you re financing your purchase, ensure you adequately assess interest rates and repayment plans to avoid stretching your budget. Paying close attention to these often-overlooked elements can significantly enhance your car-buying experience and provide greater peace of mind.

Falling for Sales Tactics

Falling for aggressive sales tactics employed by dealerships can lead you to make hasty decisions that may not align with your financial goals. Sales representatives often use various techniques, emphasizing enticing dealer incentives while downplaying potential unexpected costs to sway your choices. By being aware of these tactics and understanding consumer protection, you can navigate the sales process confidently.

It’s vital to spot these tactics! The friendly demeanor of sales staff can mask high-pressure strategies designed to close a deal quickly. For example, the allure of limited-time offers can create a false sense of urgency, leading you to overlook critical details. The negotiation process might be heavily tilted in favor of the dealership, making thorough research and clarity crucial before signing any agreements.

By arming yourself with knowledge about the vehicle and financing options, you enable yourself to make informed choices, ensuring that you are both protected and satisfied in the long run.

Frequently Asked Questions

What is the importance of understanding the fine print of new car deals?

Understanding the fine print of new car deals is crucial because it can greatly impact the overall cost and terms of your purchase. For a deeper insight, understanding the new car buying process is essential, as failing to read and comprehend the fine print can lead to unexpected fees and charges, affecting your ability to return or exchange the car.

What are some common terms and conditions found in the fine print of new car deals?

Common terms and conditions include financing terms, additional fees and charges, warranty details, return and exchange policies, and any limitations or restrictions on the deal.

How can I ensure that I fully understand the fine print of a new car deal?

To grasp the fine print, read all documents carefully. Take your time to review all terms and conditions, and don’t hesitate to ask questions or seek clarification if anything is unclear.

While not all fine print contains hidden fees or charges, it’s important to be aware of their potential presence. Some dealerships may include additional fees for services or features you may not have requested, so be sure to review all documents and ask about any potential hidden fees.

Can I negotiate the terms in the fine print of a new car deal?

In most cases, the terms in the fine print are non-negotiable. However, if you have concerns or questions, bring them up with the dealership and see if they are willing to make any adjustments. Be sure to get any changes in writing.

What should I do if I find something in the fine print that I don’t agree with?

If you come across something in the fine print that you don’t agree with or understand, address it with the dealership before finalizing the deal. You may negotiate or request changes, or choose to walk away from the deal if the terms are not to your liking.

Always ask questions and ensure you re comfortable with every detail before signing!