Understanding New Car Lease Agreements

Navigating the world of car leasing can feel like a labyrinth, especially with the myriad options and terms at your fingertips. Whether you’re stepping into this arena for the first time or simply seeking to refresh your understanding, this guide lays out everything you need to grasp about car lease agreements.

You’ll explore the nuances between open-end and closed-end leases along with essential terms like monthly payments and mileage limits. It’s all here! Plus, you ll find invaluable tips for negotiating the best deal and debunking common misconceptions that might cloud your judgment.

Dive in and empower yourself to make informed leasing choices!

Contents

- Key Takeaways:

- Types of Car Lease Agreements

- Key Terms and Clauses in a Car Lease Agreement

- How to Negotiate a Car Lease Agreement

- Common Misconceptions about Car Lease Agreements

- Frequently Asked Questions

- What is a new car lease agreement?

- What are the benefits of leasing a new car?

- What should I consider before leasing a new car?

- How is the monthly payment determined for a new car lease agreement?

- Can I negotiate the terms of a new car lease agreement?

- What happens at the end of a new car lease agreement?

Key Takeaways:

- Car lease agreements come in two main types: open-end and closed-end. Understanding the differences between the two can help you make a more informed decision.

- Be aware of key terms and clauses in a car lease agreement, such as monthly payments, mileage limits, and excess wear and tear fees. These can greatly impact the overall cost of your lease.

- Negotiating a car lease agreement is possible and can save you money. Research and prepare beforehand, and don’t be afraid to ask for better terms or walk away if the deal doesn’t meet your needs.

What is a Car Lease Agreement?

A Car Lease Agreement is a legal contract between you and the leasing company. This agreement lays out the terms for leasing a vehicle, detailing aspects like monthly payments, lease duration, and your responsibilities for depreciation (the reduction in the car’s value over time) and maintenance. It’s an essential document to consider if you’re leaning toward leasing a car instead of outright ownership, especially when you familiarize yourself with the fine print of car loans.

Generally, the lease duration can vary, often falling between two to four years. Your monthly payment will depend on factors such as the vehicle’s value and its expected depreciation. You ll be responsible for routine maintenance and insurance costs, while the leasing company retains ownership and oversees the vehicle s overall condition.

The contract usually specifies a mileage limit, and exceeding that could result in extra charges when the lease ends. By understanding these components, you can ensure that you and the leasing company are clear on your responsibilities, ultimately leading to a smoother leasing experience.

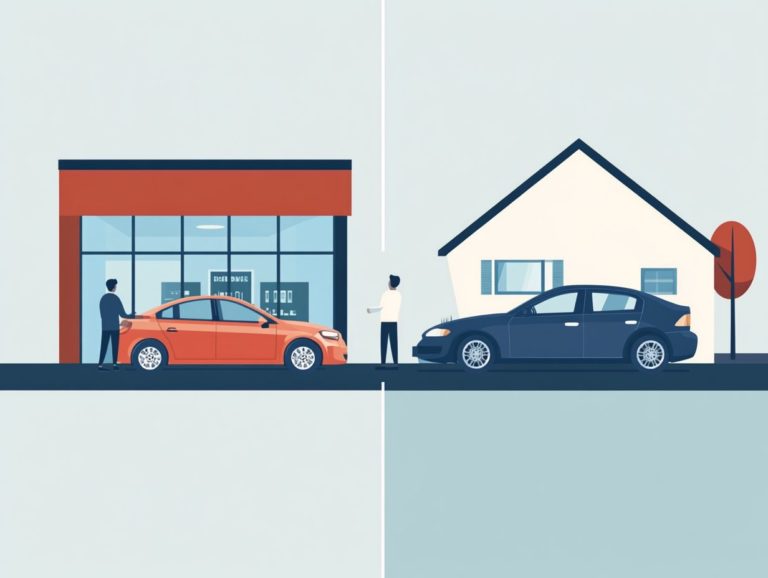

Types of Car Lease Agreements

You ll find that there are primarily two types of Car Lease Agreements: short-term leases and long-term leases. Each option caters to your unique needs and preferences, whether you re in the market for a new car or a used one.

Open-End vs. Closed-End Leases

Car leases can be divided into Open-End and Closed-End Leases, each presenting distinct benefits, especially when it comes to managing depreciation, residual value (the car’s estimated value at the end of the lease), and mileage limits.

Understanding these differences is key to making smart leasing choices! With a Closed-End Lease, you essentially face limited financial obligations once the term wraps up; you’re typically on the hook only for excess wear and tear or mileage that exceeds the agreed limits. This structure reduces the risks associated with depreciation and residual value, making it a more predictable choice for your budgeting.

On the flip side, an Open-End Lease places greater responsibility on you regarding the vehicle’s final value. This arrangement can lead to fluctuating payments based on the car’s condition and overall mileage, which might result in higher costs as the lease comes to an end.

Key Terms and Clauses in a Car Lease Agreement

Understanding the key terms and clauses in a Car Lease Agreement is essential for you as a prospective lessee. These elements play a substantial role in shaping the overall cost and conditions of your lease, influencing factors such as monthly payments, acquisition fees, and mileage limits. Additionally, being aware of understanding new car warranties can also impact your leasing decisions.

Grasping these details ensures you make informed decisions that align with your financial goals and driving needs.

Now that you’re equipped with the knowledge, jump into the leasing world with confidence!

Monthly Payments and Mileage Limits

Monthly payments in car leasing hinge on a few important factors, including the vehicle’s depreciation, the agreed-upon mileage limit, and the overall terms of the leasing agreement.

Understanding how each component influences the final figure is vital for you as a prospective lessee. Depreciation represents the anticipated decline in the car’s value over the lease term, and this amount is deducted from the vehicle’s initial cost to help calculate your payments.

Residual values, or the expected value of the car when the lease ends, also play a significant role; a higher residual value can lead to reduced monthly costs for you. Be mindful that exceeding the pre-set mileage limit can result in hefty fees, so it’s essential to choose a mileage allowance that fits your typical driving habits.

By considering all of these aspects, you can make a well-informed leasing decision that aligns with your needs.

Excess Wear and Tear Fees

Excess wear and tear fees are the charges you encounter when returning a leased vehicle that doesn t quite meet the reasonable standards outlined in your lease agreement, ultimately impacting the overall cost of your leasing experience.

These fees typically emerge from common issues like notable paint scratches, torn upholstery, or mechanical damage that exceeds the thresholds specified in your contract. When you return the vehicle, the leasing company conducts an assessment, where professionals thoroughly evaluate the car’s condition against the wear standards established at the beginning of the lease.

Understanding this process is crucial for you to avoid any unexpected charges and effectively manage depreciation.

Taking care of your vehicle can save you money and make the lease-end experience smoother! By maintaining your car throughout the leasing period, you can reduce the financial strain and ensure your budget remains intact for future automotive needs.

How to Negotiate a Car Lease Agreement

Negotiating a car lease agreement is an essential skill that gives you the power to secure the most advantageous deal available. Don t miss out on getting the best deal!

Mastering this art allows you to capitalize on favorable financing terms, which can lead to significantly lower monthly payments from the dealer.

Tips for Getting the Best Deal

To secure the best deal on a car lease, you should explore various strategies. Start by researching car manufacturers’ incentives and prepare to negotiate both the terms and financing options.

Understanding the true market value of the vehicle gives you the power, enabling informed decisions instead of just accepting dealership pricing. Evaluating multiple dealerships creates leverage, often leading to competitive offers that can significantly lower your monthly payments.

Timing is crucial; leasing at the end of the month or during holiday sales events typically yields better deals. Bringing in a pre-approved financing option can boost your position, enhancing your negotiation effectiveness and ensuring you capitalize on the most advantageous terms available.

Common Misconceptions about Car Lease Agreements

Numerous prevalent misconceptions regarding car lease agreements may induce confusion or hesitation among potential lessees, especially when it comes to understanding the final cost of leasing a car, ownership, cost, and insurance implications.

Debunking Myths and Clarifying Facts

Debunking myths and clarifying facts about car leasing is crucial for you as a person leasing a car. This knowledge enables you to make informed decisions about ways to own or use a car and understand the real nature of those monthly payments.

Understanding leasing means sorting fact from fiction. Many people think leasing is like throwing money away. However, leasing often offers more affordable monthly payments compared to financing a vehicle. Imagine driving a brand-new model without the long-term commitment!

Another common myth is that lessees face strict mileage limits. This overlooks the flexible options available, allowing you to customize lease agreements based on your driving habits. By addressing these misconceptions, you empower yourself to see leasing as a viable alternative, shaping your choices with a clearer understanding of actual costs and benefits.

Frequently Asked Questions

What is a new car lease agreement?

A new car lease agreement is a contract between you and a dealership or leasing company that outlines the terms of leasing a new car. It includes details such as the monthly payment amount, lease duration, and mileage restrictions. To fully comprehend what you’re signing, it’s crucial to delve into the fine print of new car deals.

What are the benefits of leasing a new car?

Leasing a new car can offer several benefits. You typically enjoy lower monthly payments compared to buying. For instance, you might pay $300 a month instead of $400 for a loan. You can drive a new car every few years and usually face lower maintenance costs since the car is under warranty.

What should I consider before leasing a new car?

One downside of leasing a new car is that you do not own it. You will have to return it at the end of the lease. You may also face fees for exceeding the allowed mileage or for excessive wear and tear on the car.

How is the monthly payment determined for a new car lease agreement?

The monthly payment is determined by several factors. These include the car’s purchase price, lease duration, agreed-upon mileage limit, and the estimated depreciation, or how much value the car loses over time, during the lease term.

Can I negotiate the terms of a new car lease agreement?

Yes, you can negotiate the terms, such as the monthly payment amount and mileage limit. It’s essential to research and compare lease offers from different dealerships to ensure you are getting the best deal.

What happens at the end of a new car lease agreement?

At the end of the lease, you will need to return the car to the dealership or leasing company. You may have the option to purchase the car for a predetermined price, lease a new car, or return the car and walk away.

Ready to explore leasing options? Contact us today!