Essential Resources for New Car Buyers

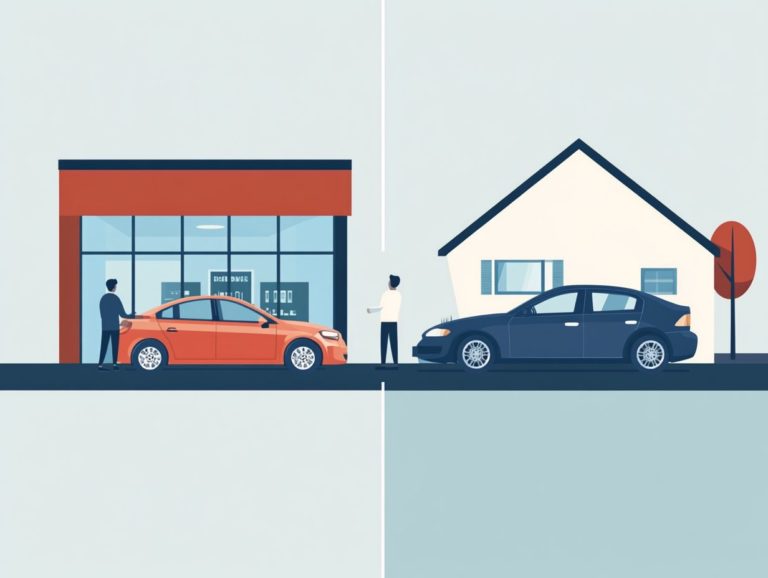

Buying a new car is an exhilarating yet daunting experience. With so many options available, it can be overwhelming.

To navigate this journey successfully, you need to consider key factors that shape your decision. Start by setting a realistic budget and exploring financing options.

This guide offers essential resources and insights to simplify your car-buying experience. We aim to make it enjoyable and stress-free.

Contents

- Key Takeaways:

- 1. Determine Your Budget

- 2. Research Different Car Models

- 3. Consider Your Needs and Lifestyle

- 4. Read Reviews and Ratings

- 5. Check for Safety Features

- 6. Look for Deals and Discounts

- 7. Consider the Cost of Ownership

- 8. Get a Pre-Purchase Inspection

- 9. Test Drive the Car

- 10. Negotiate the Price

- 11. Understand the Financing Options

- 12. Know Your Rights as a Buyer

- 13. Consider the Resale Value

- 14. Embrace the Power to Walk Away

- 15. Make Sure to Get All Necessary Documents

- What Are the Most Important Factors to Consider When Buying a New Car?

- Frequently Asked Questions

Key Takeaways:

- Determine your budget before starting your search for a new car. This helps you narrow down options and avoid overspending.

- Research different car models to find the right fit for your needs and lifestyle. Consider size, fuel efficiency, and features.

- Use resources like reviews, safety ratings, and pre-purchase inspections to make informed decisions when buying a new car.

1. Determine Your Budget

Setting a budget is a critical first step when buying a new car. It influences the type of vehicle you can afford and your monthly payments.

By crafting a budget, you ll consider car prices, financing options, and important costs like insurance and maintenance. This leads to a more confident buying experience.

Analyze your financial situation, including your credit score. A higher score can get you better loan rates and terms.

Understanding how to calculate monthly payments based on loan amounts and interest rates is crucial. This helps you understand your financial commitments.

Include all related expenses fuel, maintenance, and insurance in your budget. This ensures car ownership won t strain your finances, making for a smoother driving experience.

2. Research Different Car Models

Researching car models is essential for first-time buyers. It helps you understand market pricing, features, and reliability, and also guides you on how to prepare for a new car purchase.

Use resources like Kelley Blue Book for insights into fair market values. Online platforms like Carvana and CarMax offer transparent pricing and vehicle histories.

When choosing between new and used cars, consider depreciation, warranty coverage, and maintenance costs. Reliability ratings from consumer feedback can also guide your decision.

Taking the time to explore these resources helps you get the best value for your money.

3. Consider Your Needs and Lifestyle

Your needs and lifestyle play a crucial role in your car purchase. Ensure the vehicle fits your daily activities and long-term plans.

Evaluate your commuting patterns, family size, and preferences. For long distances, prioritize fuel efficiency, while larger families may need more storage space.

Don’t overlook safety ratings; they protect your loved ones. Understanding maintenance costs helps you budget effectively and avoid surprises.

By thoughtfully assessing these factors, you can make a well-informed choice that truly complements your lifestyle. This way, you can enjoy every drive without worries!

4. Read Reviews and Ratings

Reading reviews and ratings is essential for making an informed decision when purchasing a new car. These insights provide you with valuable information about the reliability and performance of various models, often shared by fellow consumers through automotive resources and platforms.

To assess a vehicle’s quality over time, seek out professional reviews. Exploring multiple sources will help you form a clearer picture.

When interpreting ratings, consider factors such as overall reliability, maintenance costs, and long-term performance. These elements can greatly influence your satisfaction as an owner. Keeping an eye out for common trends in reviews reveals potential issues or standout features that may impact your decision.

5. Check for Safety Features

When purchasing a new car, checking for safety features is essential. These elements protect you and your passengers and can affect your auto insurance rates and the overall reliability of the vehicle.

Look for a comprehensive array of airbags, including front, side, and curtain varieties. They provide crucial protection in a collision. Anti-lock brakes are another must-have, as they help maintain control during sudden stops. Consider advanced driver-assistance systems, such as lane-keeping assist, adaptive cruise control, and automatic emergency braking. These technologies enhance safety by offering real-time support while you re on the road.

Make sure to check safety ratings from reputable organizations like the IIHS or NHTSA. These ratings can save you money and keep you safe; higher ratings often correlate with lower insurance premiums, giving you peace of mind both in terms of safety and financial planning.

6. Look for Deals and Discounts

Searching for deals and discounts can lead to substantial savings when you’re on the hunt for a new car. This savvy approach allows you to negotiate a deal that aligns perfectly with your budget while ensuring you secure the best market pricing from dealerships.

Explore seasonal promotions, which often align with holiday sales or year-end clearances. Manufacturer incentives can significantly enhance your purchasing power, offering cash rebates or low-interest financing options that make the vehicle more affordable. Don’t underestimate the value of trade-in negotiations; they can drastically reduce the overall cost by offsetting the price of your new ride.

Act quickly to take advantage of peak sale seasons, like the end of the month or around major holidays, when dealerships are more inclined to negotiate.

7. Consider the Cost of Ownership

Considering the cost of ownership is essential for you as a prospective car buyer. It s not just about the initial purchase price; you also need to think about ongoing expenses like maintenance costs, depreciation rates (the loss in the car’s value over time), and auto insurance. All of these factors will influence your monthly payments and overall budgeting for the vehicle.

To evaluate total ownership costs, factor in routine maintenance, which can vary significantly based on the type of vehicle you choose and your driving habits. Fuel efficiency is another crucial element, as it directly impacts your gas expenses over time.

Insurance premiums can vary widely depending on the make, model, and safety features of the car you select, all of which play a role in overall affordability. Additionally, consider how depreciation affects the car s value, especially when comparing new versus used cars. New models typically lose value more rapidly in their first few years, impacting your long-term financial planning.

8. Get a Pre-Purchase Inspection

Getting a pre-purchase inspection is a vital step in your car-buying journey. This step makes sure a qualified mechanic checks the vehicle’s reliability and condition before you make a purchase.

This inspection typically covers important components like the engine, brakes, and transmission. Choosing a reputable mechanic is essential for a thorough evaluation.

Check the vehicle history report as well. This report uncovers hidden issues, such as previous accidents or title problems (issues with the legal ownership of the car), that can affect your purchase.

Understanding these steps can significantly impact the overall cost of used cars, enabling you to negotiate better prices and avoid potential pitfalls down the line.

9. Test Drive the Car

Test driving the car is an essential part of your buying journey, especially if you’re a first-time buyer. It gives you the chance to assess how the vehicle handles and feels, ensuring it aligns with your expectations for reliability and comfort.

By dedicating time to explore various makes and models, you can better understand what fits your driving style. It’s vital to put the car through its paces in different conditions whether navigating busy city streets or cruising on the highway.

During the drive, pay close attention to comfort: does the seating support you well? Is visibility optimal?

Consider how the car manages sharp turns and responds to acceleration; these elements can significantly impact your overall driving experience.

10. Negotiate the Price

Negotiating the price is an essential skill for you as a car buyer, especially when it comes to securing the best deal. It s not just about the purchase price; it can significantly impact your financing options and overall affordability in line with market trends.

To set yourself up for success, do your research on vehicle prices now. Consider factors like the year, make, model, condition, and any additional features. This knowledge will enable you to make informed offers and counteroffers, boosting your confidence during negotiations.

Familiarizing yourself with various financing terms and exploring trade-in options can also give you a distinct advantage. Enter negotiations with a clear understanding of your trade-in value and a solid grasp of financing options, and you ll be better equipped to navigate discussions.

This approach will help you work toward a more favorable agreement, ultimately enhancing your car-buying experience.

11. Understand the Financing Options

Knowing your financing options is key when you re purchasing a new car, as this choice can significantly impact your monthly payments, loan terms, and overall affordability especially if you secure loan preapproval before stepping foot in a dealership.

By exploring avenues like dealership financing versus traditional bank loans, you can navigate the complexities of auto financing with greater ease. Dealership financing often offers convenience and may come with enticing promotional rates, but it s essential to scrutinize the terms carefully. On the other hand, bank loans might provide a clearer structure with potentially lower interest rates, particularly if you possess a strong credit score.

Securing loan preapproval not only streamlines your buying process but also enhances your negotiation power. This allows you to approach dealers with confidence. Keep in mind that a better credit score can directly influence the interest rates available to you, ultimately affecting the affordability of your chosen vehicle.

Start your car-buying journey today with confidence!

12. Know Your Rights as a Buyer

Knowing your rights as a buyer is essential for a smooth car purchase. This understanding helps you make informed decisions about financing, dealership practices, and can also guide you on how to research new cars online and other key aspects.

Grasping the intricacies of warranties, return policies, and the terms laid out in financing agreements can greatly impact your overall satisfaction and financial well-being. It s wise to take the time to thoroughly read the fine print and ask questions if anything seems vague.

Numerous resources are available to assist you in navigating your rights, including government websites and consumer advocacy groups that offer valuable insights and support.

By staying well-informed, you can protect yourself from potential pitfalls and ensure that you re making sound investments in your future mobility.

13. Consider the Resale Value

Thinking about a vehicle’s resale value is important. It affects your initial investment and your long-term finances because cars lose value over time.

To make well-informed decisions, you ll want to evaluate several factors that impact a car’s resale value. Brands with strong reputations typically experience less depreciation, and popular models often retain their value more effectively. It s also wise to consider the vehicle’s history and condition, as well as its standing in the automotive market.

To aid in your assessment, resources like Kelley Blue Book and Edmunds offer invaluable insights, complete with tools for tracking depreciation rates and estimating future resale values. Delving into market analysis reports can further enable you to make savvy investment choices.

14. Embrace the Power to Walk Away

Don t be afraid to walk away from a deal that doesn t meet your financial expectations! This can lead to better negotiations and help you find a reliable vehicle within your budget.

This strategy not only helps you stay true to your financial goals but also sends a strong message to the dealer that you have clear boundaries. For instance, if a dealership insists on a price that s simply out of reach, taking a step back might just encourage them to rethink their offer. Similarly, if you’re unsure about the financing terms, walking away could prompt them to present you with better interest rates or enticing perks to keep your business.

Always remember, every negotiation should aim for a win-win outcome. Sometimes, showing that you re ready to walk away can provide you with the leverage needed to secure an even better deal.

15. Make Sure to Get All Necessary Documents

Gather all necessary documents for your car buying journey. Proper paperwork ensures a smooth transaction and protects your interests.

To successfully maneuver through this process, having your proof of income readily available is essential, as lenders often require it for financing approval. Obtaining a comprehensive vehicle history report can offer valuable insights into the car’s past, helping you sidestep potential pitfalls.

Don t overlook the importance of insurance information; most dealers will need proof of coverage to finalize the sale. Meticulously verifying all documents before closing the deal is vital. This step not only safeguards your investment but also instills confidence in your decision, ensuring that you re making a well-informed choice.

What Are the Most Important Factors to Consider When Buying a New Car?

When you’re in the market for a new car, it’s essential to consider several key factors. Think about the features that cater to your lifestyle. To navigate this journey effectively, check out understanding the new car buying process. Explore financing options that fit within your budget, and keep an eye on pricing to ensure you’re making a savvy choice as a first-time buyer.

It s vital to examine the various vehicle models available and their safety ratings. These elements can significantly affect your long-term satisfaction and peace of mind. Prioritizing your personal needs whether it’s passenger space or fuel efficiency will help you find a vehicle that integrates seamlessly into your daily routine.

Researching financing options is key to saving money. It allows you to identify monthly payments that won’t strain your finances. By striking a balance among these factors, you can pave the way for a rewarding ownership experience.

What Are the Benefits of Buying a New Car vs. a Used Car?

The advantages of purchasing a new car over a used one are numerous. These include enhanced reliability, typically lower maintenance costs, and the allure of modern financing options that can make your investment feel more manageable over time.

A new vehicle generally comes with a full warranty, giving you peace of mind. However, this security does come at a premium price that might not fit everyone s budget.

Conversely, used cars can provide substantial savings, though they may not guarantee the same level of reliability or warranty coverage. You might discover that a certified pre-owned vehicle, often backed by extended warranties and rigorous inspections, serves as an excellent compromise between the two options.

Ultimately, the choice hinges on your personal circumstances. For instance, a new car might be perfect for you if you prioritize the latest technology and safety features. A more budget-conscious shopper could find greater value in the affordability of a used model.

What Are the Common Mistakes to Avoid When Buying a New Car?

Common mistakes made by first-time car buyers can lead to overspending and regret. It’s essential for you to prepare thoroughly and grasp the bargaining tips found in your guide to car financing for first-time buyers that can help you avoid costly errors when purchasing a new car.

One frequent pitfall is failing to research vehicle pricing, leaving you vulnerable to inflated costs. If you neglect to consider the total cost of ownership like insurance, maintenance, and fuel expenses you risk creating financial strain down the line.

It’s also crucial for you to be ready to negotiate; many first-time buyers walk in unprepared, missing out on potential savings. To combat these issues, take proactive steps such as comparing prices through online marketplaces and calculating long-term expenses. Practicing negotiation techniques can make a significant difference.

With these tips, you can tackle the car buying process confidently.

How Can Researching and Planning Help with the Car Buying Process?

Researching and planning effectively can elevate your car buying experience, enabling you to make informed decisions about vehicle pricing, financing options, and key features that align with your needs and budget. For a comprehensive understanding, refer to the new car buying process.

By dedicating time to thorough research, you ll gain a deeper understanding of current market trends. This knowledge not only illuminates the pros and cons of specific models but also uncovers financing alternatives that may better suit your financial situation.

Establishing a structured plan enables you to set realistic expectations. This makes it easier to align your choices with your long-term financial goals. This approach helps you steer clear of impulse decisions that could lead to regrettable purchases or financial strain, ultimately contributing to a more rewarding car ownership experience.

Start your car shopping journey today and drive away with the best deal!

What Are Some Additional Resources for New Car Buyers?

There are numerous resources available to you as a new car buyer, including guides on how to use online resources for car buying, designed to simplify the buying process from exploring financing options to securing a report that shows a car’s past.

Diving into online car buying platforms can transform your experience, placing an expansive selection of vehicles and competitive pricing at your fingertips. By utilizing tools to help you calculate costs found on various consumer advocacy websites, you can evaluate monthly payment options and potential loan terms, ensuring your choices align with your financial goals.

Engaging with reputable dealerships known for their transparent practices fosters trust throughout the buying process. Accessing services that provide comprehensive vehicle history checks gives you critical insights, enabling informed decisions about your investment.

Frequently Asked Questions

Top Resources Every New Car Buyer Should Know

Essential resources for new car buyers include online car buying guides, consumer reports, dealership ratings and reviews, vehicle comparison tools, and tips for first-time new car buyers.

What Are Online Car Buying Guides?

Online car buying guides provide detailed information on the buying process, including tips on negotiating, car financing options, and researching different vehicles.

How Can Consumer Reports Help New Car Buyers?

Consumer reports offer unbiased reviews on various car models, helping buyers make informed decisions based on reliability, safety, and performance.

Why Is It Important to Check Dealership Ratings and Reviews?

Checking dealership ratings and reviews helps buyers find reputable dealerships, ensuring a positive car buying experience.

What Is a Vehicle Comparison Tool?

A vehicle comparison tool allows buyers to compare different car models side by side, making it easier to see differences in features, pricing, and overall value.

How Can Financial Calculators Benefit New Car Buyers?

Financial calculators help buyers estimate monthly payments, compare financing options, and determine the overall cost of owning a vehicle.

Ready to dive into your car buying journey? Explore these resources today!